To be part of a modern nonprofit financial office is to witness fingers flying over keyboards as information is entered expertly into the accounting system. Your financial team is experienced at doing piles of work in a short amount of time to get books closed and reports out the door while the information is still actionable.

But even for professionals, the flurry of data entry can open the door to a plethora of potential errors. The more steps in the process, the more chances for a mistake. And a single mis-entry can send your productivity to a halt as you search for the error—or worse, your team could distribute incorrect information to your leadership and donors.

Using a fund accounting system with a segmented chart of accounts requires fewer clicks and selections to track an expense, which reduces the potential for errors and helps to ensure your data integrity.

The Importance of Data Integrity in Nonprofit Accounting

Good data health is vital for any accounting team, but nonprofits have even more people who count on accurate information from your financial office. Errors in your nonprofit financial data can not only cause issues in your planning and budgeting processes, but you could also lose grant funding—or donor trust—if you aren’t tracking your expenses properly.

As a nonprofit organization, you have a variety of stakeholders—from your internal leadership and Board members to donors and grant funders—who want to know that the organization is using funds appropriately. And high-level overviews in an annual report won’t cut it for many of your engaged audiences. Because they are used to seeing real-time, actionable data in other areas of their life, your large donors and Board members expect to see granular data on your programs that’s no more than a few weeks old.

And, of course, if you earned a government grant, the reporting can be even more complex. You may be compiling reports with a pass-through entity or collecting information from contractors as part of the grant. And if you are working with a reimbursable grant, if your numbers don’t line up, you may not get the reimbursements you need to pay your contractors for the work they’ve already completed.

Data integrity isn’t just important for your external audiences. You need good financial data if you want clear and accurate forecasting. It’s difficult to plan for potential growth if you aren’t sure what your true expenses were this year, or if your income wasn’t tracked correctly. Without confidence in your financial figures, your nonprofit organization cannot reach its true impact potential.

Whitepaper

4 Ways Personalized Reporting Helps Your Nonprofit Make Better Strategic Decisions

Why Your Fund Accounting Software Needs a Segmented Chart of Accounts

Accounting software often comes in two types: segmented or dimensional. Dimensional, also called table-based, tracks each element in your chart of accounts separately. Each input is a distinct decision with one correct answer, such as 01 for Restricted Funds, 5003 for the general ledger for consulting fees, and cost center 203 for Department 3.

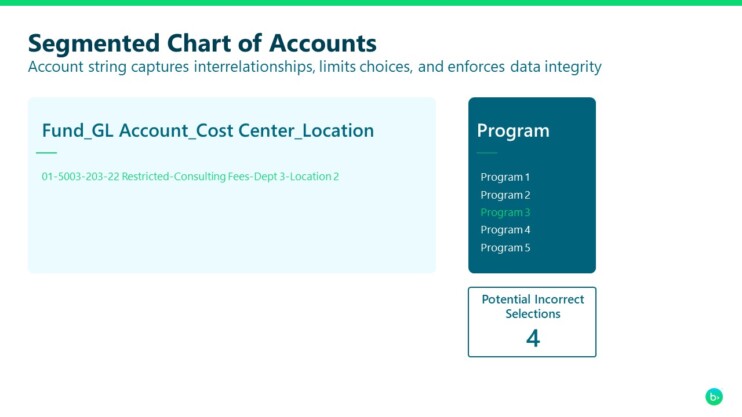

A segmented chart of accounts, however, ties all the pieces together into one string, such as 01-5003-203 for expenses that fall under restricted funds for consulting fees associated with Department 3. You make one selection, and you can see the relationships clearly.

By simplifying the data entry process with one selection instead of choosing several different dimensions, your segmented chart of accounts is more accurate and easier to learn. You maintain data integrity with fewer errors because there are fewer options, which also simplifies your audit trail and makes your audit preparation faster.

Because the relationships are clearly defined with a segmented chart of accounts, it’s easier for new members of your team to get acclimated faster. They only have one choice to remember, and they can see all the pieces at once.

And there is no difference in tracking, reporting, or budgeting capabilities with a segmented chart of accounts. The segments act as filters to help you look at your data from a variety of angles. You can pull all your standard reports simply and easily.

Hundreds of Possible Errors in Your Chart of Accounts—Or Four

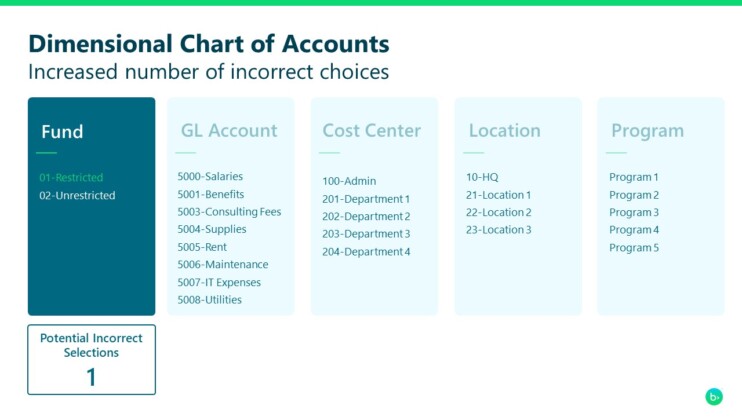

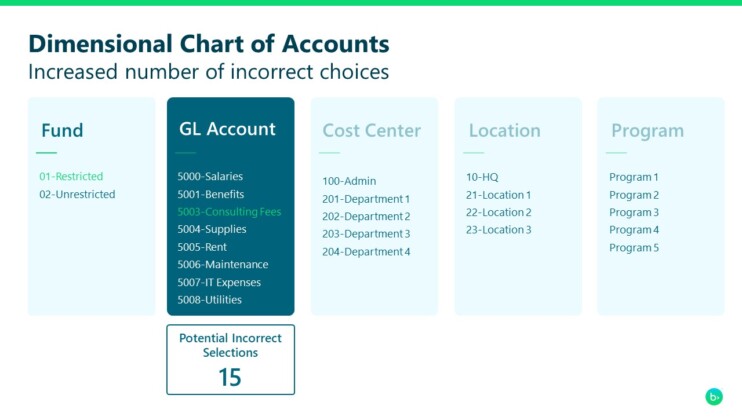

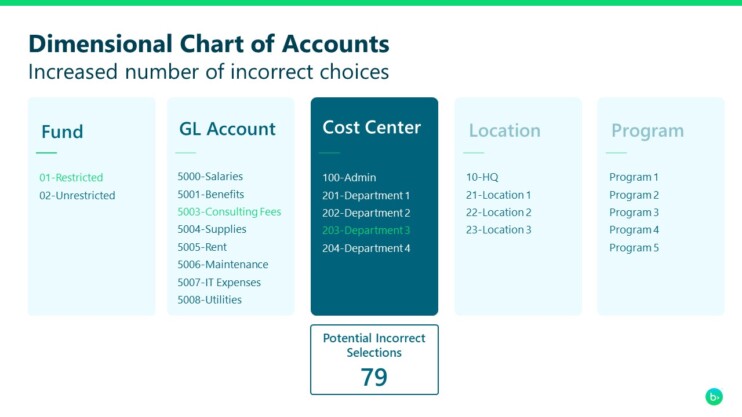

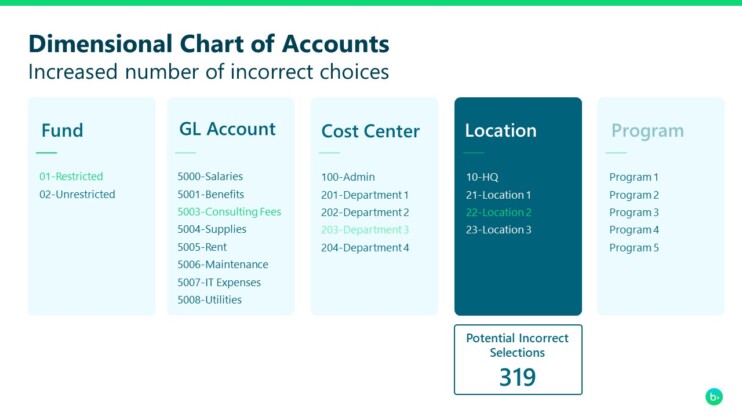

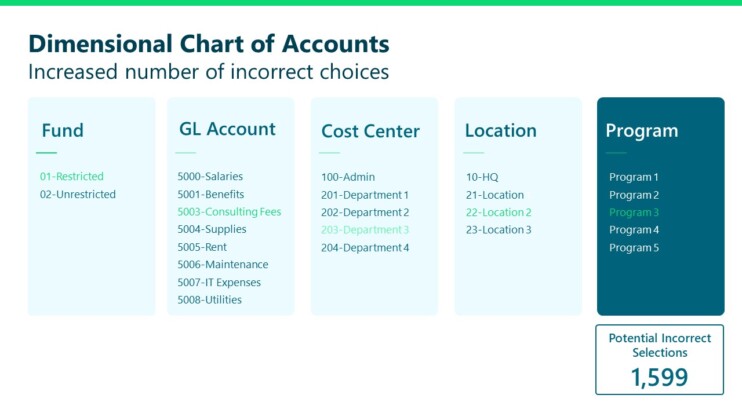

Here’s how using a dimensional chart of accounts creates the potential for hundreds of incorrect choices.

The first option is Fund, either restricted or unrestricted. In this example, we want 01-Restricted, leaving only one wrong choice.

The second option in this example is General Ledger. This expense is for 5003-Consulting Fees. For simplicity, we only have eight GL options, but in reality, this list could be much longer. Assuming the user selected the correct fund, they now have seven incorrect options. But if they didn’t select the correct fund, the incorrect choices double.

Now we select the Cost Center. Like General Ledger, we’ve only listed five options, but your list might be longer. Even with only four incorrect options, the number of ways to get this entry wrong grows significantly.

The fourth choice is the location. For some organizations, they may only have a single location, or they may have a location in every state or in countries throughout the world. For this example, we have a headquarters and three satellite locations.

And finally, we get to the program where the expense should fall. For this example, we have five potential programs, which brings us to one correct string—01-5003-203-22-Program 3—and more than 1,500 incorrect selections.

In a segmented chart of accounts, you select the entire string, leaving only the program allocation. And if you incorporate embedded internal controls within your fund accounting software, you can allow only certain accounts with certain projects or programs, which limits the choices available and enforces data integrity. With those automatic internal controls, the potential incorrect options could be zero!

Choose a Fund Accounting System that Promotes Data Integrity

Your team cares immensely about the impact your nonprofit is making—otherwise they would not be working this hard. Support them with a fund accounting system that simplifies many parts of your nonprofit accounting, from expense management to easily tracking grant programs. Simple and integrated processes make it easy to maintain internal controls and keep your data accurate.

For a look at a segmented chart of accounts in action, join us for our next product tour of Financial Edge NXT, and see how you can improve your data integrity and create more impact.

Fund Accounting Software that Drives Impact

Find out how Blackbaud’s Financial Edge NXT® fits your organization.

The post How a Segmented Chart of Accounts Reduces Errors in Your Nonprofit Accounting first appeared on The ENGAGE Blog.

0 Commentaires